Concerns Arise Over Potential Acquisition of Mexican Bank Due to Costa Rica Wiretaps

Concerns Arise Over Potential Acquisition of Mexican Bank Due to Costa Rica Wiretaps

A Costa Rican fugitive wanted on suspicion of leading an international fraud and money laundering ring may have tried to set up a financial operation in Mexico, according to leaked records.

Abraham Chaves Arias, whom Costa Rican prosecutors have named as a suspect in one of the largest alleged fraud schemes in the country’s history, known as the Madre Patria case, was caught on wiretap telling a business associate in May 2023 that he had “made a deal with some cousins of mine” in Mexico to buy what he described as a “representation” at a bank.

The man on the other end of the line was apparently impressed, according to records of the wiretapped conversation included in a prosecutorial case file obtained by OCCRP.

“You’re crazy, man!” his interlocutor replied. “Son of a bitch … they can move the money there freely!"

The bank is not identified in the records, but OCCRP has learned that one of Chaves’ first cousins did take a leading role at a Mexican bank around the same time the call took place.

The Chihuahua-based bank Bankaool reported in its June 2023 quarterly filing that Oscar Moisés Chaves Ramirez had been appointed deputy director general on June 6 — just 12 days after the wiretapped call. Bankaool has also said that a technology company called Grupo Omni became the bank’s “majority investor" earlier that year, and that Chaves was the company’s CEO.

Since then, Moisés Chaves, as he is better known, has become the public face of Bankaool, leading a rebrand positioning it as “Mexico’s first digital bank.” Bankaool has also embarked on an aggressive marketing campaign, including a partnership with one of Mexico’s most popular soccer teams.

But while Moisés Chaves promotes himself as a fintech entrepreneur, reporters found that he is wanted in his native Costa Rica on fraud charges and that some of his previous business ventures have ended in acrimony.

Bankaool did not respond to requests for comment on Abraham Chaves. Moises Chaves, however, strongly denied his cousin had any involvement in the bank deal.

“It’s inevitable that some people, due to blood relations or friendships, spread unfounded rumors about my businesses, but I can’t control the falsehoods others decide to spread.”

When asked who he represented when he invested in Bankaool he said: “I made the acquisition in my personal capacity,” adding that Abraham Chaves did not have any connection to the transaction.

Moisés Chaves said the money for the takeover had come “from investments,” without giving any further detail. “These are legitimate funds, duly verified in the processes that I have legally had to undergo under Mexican regulations.”

He also claimed that his first investment in the bank was not made until 2024, the year after the wiretapped call.

“Furthermore, all of these transactions were subject to rigorous verification processes by Mexican regulators, and it’s important to emphasize that none of these investments originate in Costa Rica,” he added.

However, more than two years after Bankaool first announced a change of leadership, Mexican regulators have still not approved Moisés’ takeover of the bank, even though he is playing a leading role there.

Mexico’s banking regulator, the National Banking and Securities Commission (CNBV), told reporters in February that “the departments involved are currently working on their processes.” It has not responded to requests for updates since then.

Bankaool itself told reporters in January 2025 that the conversion of Moisés’ investment into share capital was still pending regulatory clearance.

“Once the corresponding approval is received, Moisés Chaves will acquire additional shares from current shareholders, making him the bank’s majority shareholder,” a press relations firm representing Bankaool wrote.

And Moisés told reporters in May that the question of whether his investment had been converted into shares was “confidential.”

He added that he had made several investments in Bankaool, but the “main transaction” was still ongoing, due to what he said was a legal process.

A Criminal Organization In Need of Moving CashThe Madre Patria case involves tens of millions of dollars worth of high-value properties that authorities suspect were stolen from their owners — often elderly people or foreigners — by falsifying ownership documents. The properties were then sold, and the proceeds were laundered through crypto exchanges.

Costa Rican authorities launched an investigation in 2022 after receiving a tip from Spanish police that almost 12 million euros (around $12.7 million at the time) had been wired to a Spanish cryptocurrency exchange before being immediately transferred elsewhere.

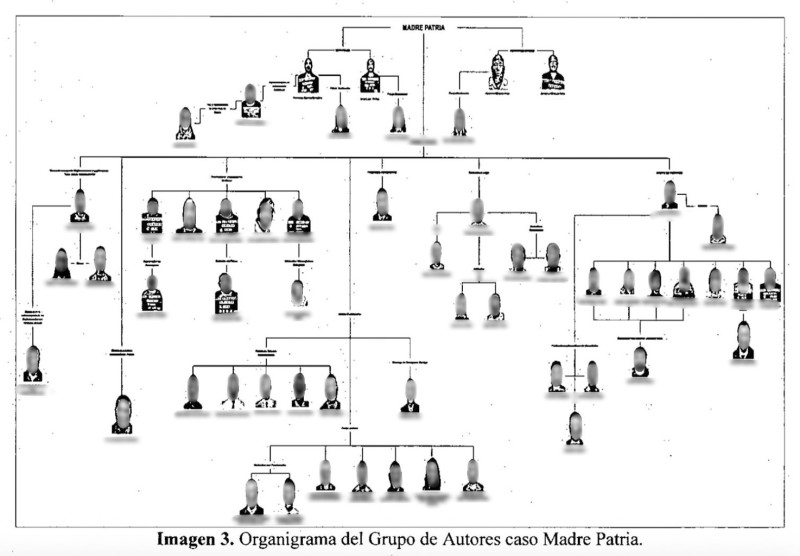

The case earned the name Madre Patria, or Motherland, because two of the prime suspects are Spanish citizens. The other two major suspects, Abraham Chaves and his brother Jonathan, a lawyer and notary, are described in the case file as “secondary” leaders in the alleged fraud ring.

According to authorities, Abraham Chaves has left Costa Rica and an Interpol Red Notice has been issued for his arrest. His current whereabouts are unknown. Jonathan Chaves was detained in June 2024, when authorities raided 47 properties across five towns in Costa Rica in relation to the case, arresting a total of 36 people.

The Madre Patria case is still under investigation by prosecutors and none of the suspects has been formally charged, but a 6,000-page leaked case file obtained by El Observador and shared with OCCRP lays out the allegations in detail, including claims that the alleged real estate scheme was abetted by notaries, lawyers, and other public servants.

Abraham Chaves could not be reached for comment. A lawyer for Jonathan Chaves said that his client was not a leader of a criminal gang and asserted that prosecutors had “corrected” any such characterization. Jonathan Chaves’ only role was “to defend the interests of his clients, as would any legal professional,” he said.

Prosecutors confirmed that Jonathan Chaves was still a suspect in the case and still in preventative custody. They did not respond to a query about whether the accusations against him had changed.

The leaked documents from the prosecutors’ case file include a diagram that outlines the alleged structure of the group, with Abraham and Jonathan Chaves shown among the leaders. While two Spanish citizens are identified in the file as the prime suspects in the case, Abraham and Jonathan are also described as having “allegedly led” the group behind the scheme.

Abraham and Jonathan are the sons of Omar Chaves, according to the case file, a notorious Costa Rican businessman who was sentenced to 35 years in prison in 2007 for ordering the murder of journalist Parmenio Medina, as well as an additional 12 years for fraud. Media reported in 2018 that he was under house arrest after being released from prison for health reasons.

Madre Patria investigators tapped several phone numbers as they built their case, and transcripts of some of their wiretaps are included in the case file.

In an analysis of the recorded call where Abraham Chaves talks about buying into a bank in Mexico, Costa Rican prosecutors noted that the conversation should be interpreted in the context of a criminal organization that was “in need of moving capital through accounts” in ways that concealed the origins of the funds. Prosecutors also stated that Abraham and others had made “several trips together to Mexico” to “establish and finalize” an ongoing negotiation.

Immigration files reviewed by reporters confirm that both Abraham and Moisés Chaves made multiple trips in and out of Costa Rica around the time that Abraham was recorded discussing his visits to Mexico to seal the “bank” deal.

Costa Rica’s Deputy Prosecutor’s Office Specializing in Organized Crime said it could not confirm whether Bankaool is involved in the Madre Patria case, citing the confidentiality of the ongoing investigation.

Moisés Chaves has not been named as a suspect by Costa Rican authorities in the Madre Patria case. He told OCCRP that there was “not any link that connects me with illegal activities.”

He also said he had no business ties to his cousin.

“He is only my cousin,” he said. “He has always lived in Costa Rica, and I have been to Singapore, Mexico, and other countries. Our worlds do not intersect.”

However, the Madre Patria case documents do contain references to Moisés Chaves, indicating he was known to suspected members of the alleged fraud ring.

In one case, members of the alleged crime group suggested Moisés could act as a mediator in a financial dispute that some of them were having with an American citizen. In another conversation, they were recorded speaking about building warehouses on land owned by Moisés.

In response to questions from OCCRP on these wiretaps, Moisés Chaves said that his cousin had approached him about selling his property, but the deal never took place.

“People can talk to each other and mention a third person without that meaning that the third person is aware of what the original two people are talking about,” he said.

“Many relatives, acquaintances, childhood friends, and distant relatives think they can call me when something gets complicated in their lives, but that does not mean that I’ll help; it’s common sense.”

Acrimony, Debt And Fraud AllegationsWhile his cousin Abraham remains on the run from the Madre Patria investigation, Moisés Chaves is not keeping a low profile.

He frequently speaks to media about his plans to expand and revolutionize the bank by offering online financial services. At a banking convention in Mexico in May, Moíses talked of the next phase of “exponential growth” planned for Bankaool.

He has even floated the idea of renaming the bank “Omnibank,” which was approved by the bank’s shareholders last year. Several companies linked to Moisés or his family members use the word “Omni” in their name, including Grupo Omni which was cited by Bankaool as their new majority investor.

What Is Grupo Omni?

Although local and international media have reported that Grupo Omni purchased Bankaool, it is surprisingly hard to determine what exactly Omni is.

In a personal message as part of Bankaool’s annual report for 2023, Moisés Chaves wrote that Grupo Omni had decided to invest in Bankaool at the end of 2022, and had since “assumed the direction and control of the institution.” Bankaool said in the same report that it had received “new leadership from Grupo Omni with a clear strategic vision and multi-million dollar investment.” It described Grupo Omni as a technology development company.

But OCCRP reporters were unable to find any record of a company by this name in any of the jurisdictions where Moisés Chaves has operated.

Some media reports have described Grupo Omni as made up of Costa Rican investors, but Moisés told OCCRP he had acquired Bankaool in his personal capacity. OCCRP asked him to explain Grupo Omni’s corporate structure or constituent parts, but he did not respond.

Three weeks after reporters sent him questions about the nature and composition of Grupo Omni, a page about the group appeared on Wikipedia, describing it as a technology company founded in Singapore in 2017 by Moisés and his brother. Reporters could find no trace of it in Singapore’s company registry.

Several companies in which Moisés or his family members were directors use the word “Omni” in their name. Reporters found a dissolved Omni Holdings Limited in Hong Kong, an Omni Sharing Pte Ltd in Singapore, and Panamanian companies called Omni Holdings Enterprises SA, Omni e-Commerce SA, and Omni Tech Solutions SA. It’s not clear whether any of these companies are behind the investment in Bankaool.

The website for OmniLabs, a company named by Moisés on Bankaool’s site as bringing “momentous change” to the bank, promotes a range of fintech services and lists offices in Costa Rica, Panama, Singapore and the United States. Most of the addresses correspond to co-working venues, and links out to websites for fintech services are broken.

But as Moisés Chaves positions himself publicly as a go-getting businessman, records uncovered by reporters show a complicated business background — and reveal that he is currently wanted in Costa Rica on two counts of major fraud. A spokesperson for Costa Rica’s judiciary told OCCRP that a warrant had been issued in February for his arrest because he had not appeared in court for a hearing related to the fraud charges. The judiciary later confirmed that he is subject to an international arrest warrant seeking his extradition.

The fraud charges against him had been laid in October 2020, according to Costa Rica’s Public Prosecutors Office.

Moisés told reporters in May that a case was ongoing and that it revolved around an accusation over an unpaid debt to a Costa Rican financial institution, which he described as “absurd.”

The Costa Rican judiciary spokesperson confirmed that the financial institution was the “injured party” in the criminal case being brought against Moisés.

Before taking on his role at Bankaool, Moisés Chaves had been involved in bike-sharing ventures in Asia and Costa Rica, and he has spoken of ambitions for a “super app” for Costa Rica that would include both taxis and fintech offerings.

Some of these ventures appear to have ended in acrimony and debt.

In 2019, Singapore media reported on his investment in oBike, a troubled bike-sharing firm whose operation in Singapore had gone into liquidation. The situation led to a public dispute between Moisés Chaves and the company’s liquidators, carried out in the pages of local newspapers. Asked about the issues with oBike, he told OCCRP reporters he continues to work with oBike’s main shareholder, and that he was considered “the ‘White Knight’...who intervened to resolve oBike’s financial problems.” OBike is reportedly no longer functioning as a business.

Later in 2019, Costa Rican media reported the launch of an electric bike rental service dubbed OMNi Bicis, which would operate in partnership with Costa Rica’s Savings and Personal Loans Cooperative, or Coopenae, one of the largest savings and credit cooperatives in the country. Moisés told OCCRP his companies “operated as a technology partner” of Coopenae in the project.

But by August 2021, Coopenae had publicly disassociated itself from the bike rental venture. El Observador reported that Coopenae had announced the suspension of its relationship with a company called Apptitud ZF, which the newspaper described as “a subsidiary of Omni,” and which managed an e-wallet used by bike rental customers. The decision had come after Costa Rican authorities opened a procedure against Coopenae related to “services it provided to clients of the Omni platform,” according to the report.

Records from three public bodies in Costa Rica show that Apptitud ZF owes them at least 800 million colones (around $1.9 million).

Asked about the outstanding debts in Costa Rica, Moisés told reporters: “All client funds were always under the custody of Coopenae, ensuring security and transparency. When the business relationship with Coopenae ended, those who held OMNi-COOPENAE cards had their savings liquidated or their funds migrated to Coopenae’s … neobank.”

Coopenae did not respond to a request for comment.

Then, with no apparent previous experience as a bank executive, Moisés moved on to take a leading role at Bankaool.

A Rural Lender With Big AmbitionsBankaool started life as Agrofinanzas, a loan provider set up in 2005 and serving agricultural producers in Mexico’s northern Chihuahua state. It became Bankaool in 2014 after obtaining approval from regulators to operate as a bank and offer a wider variety of financial products.

But the bank struggled to stay in the black and was acquired in December 2018 by a new group of shareholders, including an American former bank executive, Bradley Charles Hanson.

Hanson held 45 percent of Bankaool’s shares following the takeover, and as of September 2024 still held 54 percent of the bank’s shares, according to Bankaool’s financial statements. (Hanson did not respond to requests for comment.)

Bankaool booked a profit only once between 2018 and 2022. S&P Global downgraded the bank’s rating in April 2023 and reported it had suffered “the continued weakening of its capitalization levels due to recurring net losses, which have not been fully offset by capital injections.”

The S&P report mentioned that Grupo Omni had signed an agreement that month to take a majority share in the bank, subject to regulatory approval.

“The bank’s new shareholders are committed to strengthening its financial position by providing it with new financial resources,” the report said.

Bankaool made a profit of 327 million pesos ($15.7 million) in 2024, the largest in its history.

Despite the ongoing lack of regulatory approval for his takeover, Moisés’ vision for the bank is nonetheless ambitious. He told Reuters last year that Bankaool expects to debut on the U.S. stock market by early 2026.

Смотреть все новости автора

Распечатать